Tom Yeung here with your Sunday Digest.

Last week, I wrote about “Gravity Pleasure Road,” the world’s first modern roller coaster with a built-in lift hill that could pull cars back up a slope. Stocks had been on a roller-coaster ride, and a rare economic event suggested that a similar “lift” was on the horizon.

As Luke Lango outlined in a presentation on Wednesday, he believes we’re only in the early innings of “The Great Tech Reversal of 2024.” If macroeconomics evolves as it has in the past, markets should see multiyear booms like we saw in the late-1990s and post-Covid years.

We’re already seeing the signs of an improving outlook. Since our last update, the tech-heavy Nasdaq-100 is up 4%, and one of our picks from last week, Informatica (INFA) has risen 6%.

Better yet, we continue to see more gains to come. To understand why, you can still watch Luke’s presentation, which will be available for a limited time here.

In the meantime, our team has picked out another three AI stocks that we believe will benefit from this enormous reversal happening before our eyes…

AI-Powered Coding

Shares of tech firm GitLab Inc. (GTLB) fell as much as 49% this year after management provided full-year forecasts that fell below Wall Street estimates. Revenues are “only” expected to rise 26% to $728 million, while operating profits are “only” expected to reach $5 million to $10 million.

We say “only” because GitLab’s expected growth rates are still nothing short of astonishing. Analysts expect the firm’s revenues to rise in the mid-20% range through 2028, and for earnings to quintuple over the same period.

That’s because GitLab (not to be confused with GitHub) is benefiting from rapid improvements in AI for programming… and the rising expectations that come with it. As GitLab CEO Sid Sijbrandij recently noted, organizations are under increasing pressure to deliver software faster and find real use cases for AI.

“They’re looking beyond just code generation,” Sijbrandij said in his company’s Q2 earnings call. “They are looking to integrate AI into all aspects of software development to deliver tangible results.”

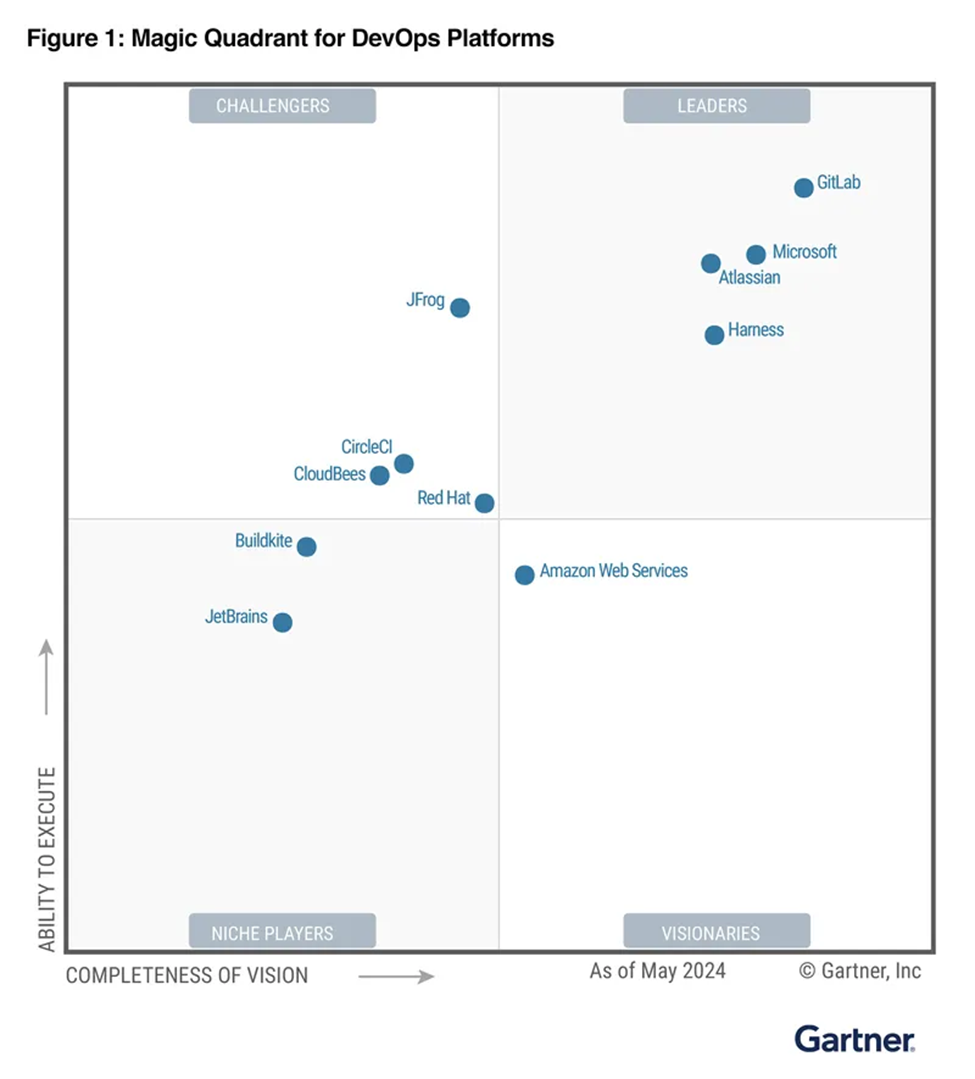

That’s where GitLab comes in. The company is a “DevSecOps” firm – short for development, security, and operations – that helps programmers collaborate, automate product delivery, and add built-in security to the software they develop. Gartner ranks GitLab as the industry leader in its annual Magic Quadrant rankings.

GitLab has also been quick to adopt AI programming in its own products. Users paying for premium features have access to increasingly powerful AI tools that can even write code for users. As Luke noted in a recent update:

It’s time to pay attention to the “other guys” in the AI Boom…

Coding solutions provider GitLab (GTLB), meanwhile, just reported stunning quarterly results in which revenues rose more than 30% year-over-year thanks to surging demand for its new AI coding assistant tool, GitLab Duo.

That stock is up more than 30% over the past month.

Furthermore, Luke’s anticipated tech reversal should improve enterprise demand. We’re already seeing some green shoots from GitLab itself, with Q2 revenues of $183 million beating Wall Street estimates by 3% and earnings per share of $0.10 beating by 50%.

That’s why we’re turning bullish again on this overlooked stock. Shares continue to trade 31% below its 2024 highs, and we believe a sustained tech recovery will move GitLab back to previous valuations.

Riding Cloud Demand

Seagate Technology Holdings PLC (STX) is one of the two major players of the hard disk drive (HDD) industry – a cyclical business that has historically sees booms and busts every three to five years. PC upgrade cycles can cause unit demand to swing wildly, and the relatively inelastic supply of HDDs means prices will exaggerate these peaks and troughs. Revenues at Seagate have swung as much as 40% from midpoint levels.

That makes this particular upcycle particularly notable.

Over the past several years, Seagate has been transitioning its portfolio to focus on mass-capacity drives for cloud providers. AI requires enormous amounts of storage space, and analysts at Goldman Sachs believe that around $1 trillion will be spent over the next few years on data centers and other AI-related infrastructure.

That will create a new boom period for Seagate’s business. Analysts believe the company’s revenues will surge as much as 40% this year and another 13% in fiscal 2026. High operating leverage means profits could rise more than seven-fold from 2024 levels.

Louis Navellier’s Portfolio Grader has also picked up on these changes. This week, the system upgrades Seagate from “Buy” to “Strong Buy” on rising earnings momentum and positive analyst revisions. These are traditional signals of greater gains to come, because markets tend to be slow to incorporate improved expectations. Analysts have now raised their 2026 earnings estimates by 50% since the start of 2024.

Of course, investors will need to keep their finger on the “Sell” trigger once the boom subsides. HDDs are losing market share to solid-state drives (SSDs) in the consumer market, and we believe high-performance data centers could eventually go that route as well. Seagate has a far weaker competitive position in SSDs.

However, we see the downcycle as still relatively far into the future. For those with a one- to two-year time horizon, Seagate’s recent selloff provides an attractive entry point to a company benefiting from a new business cycle.

The Doctor Will See You Now

Finally, Eric Fry notes this week that current market conditions are particularly favorable for the healthcare and tech sectors. In his weekly roundup he writes:

These sectors tend to thrive during mid-stage recoveries. With high upfront research and development investments, they eventually reap benefits from lower interest rates, which cut borrowing costs and enhance profitability.

There are plenty of excellent health-tech firms that span both industries. Dozens of startups focusing on using AI in drug development have popped up in recent years, and many established firms like Novo Nordisk A/S (NVO) are pouring billions of their own dollars into the same field. However, drug discovery is inherently risky, and it’s often difficult to know which drug candidates will succeed in clinical trials.

That’s why I’d like to highlight Oscar Healthcare Inc. (OSCR) as an alternative way to invest at the intersection of health-tech without the risks that come with drug development.

Oscar is a tech-forward health insurance startup. The firm was started in 2012 to “create the kind of health insurance company we would want for ourselves,” and it now offers health plans through a superior tech platform. Users can create personalized plans, visit virtual primary care physicians (PCPs), and access a provider network that has been optimized for quality and cost.

These relatively straightforward improvements have helped Oscar differentiate itself from legacy insurers. The company receives one of the higher net promoter scores in the industry (a reflection of its policyholder loyalty) and is on track to increase revenues by 20% annually through 2027.

Oscar also scores well on Louis’s Portfolio Grader for its excellent sales growth, positive earnings surprises, and institutional buying. Shares have more than doubled in 2024 as smart money investors pivot toward the healthcare and tech sectors.

Fortunately, the New York-based insurer still appears to trade at a discount. Shares remain a third below their 2021 IPO levels, and its rapid earnings growth rate means its forward price-to-earnings (P/E) ratio is low. Shares trade at just 12 times 2026 earnings – not much higher than slower-growing legacy insurers. Considering Oscar’s long runway for growth, we believe the start of this new tech cycle will benefit the firm handsomely.

An Unusual September

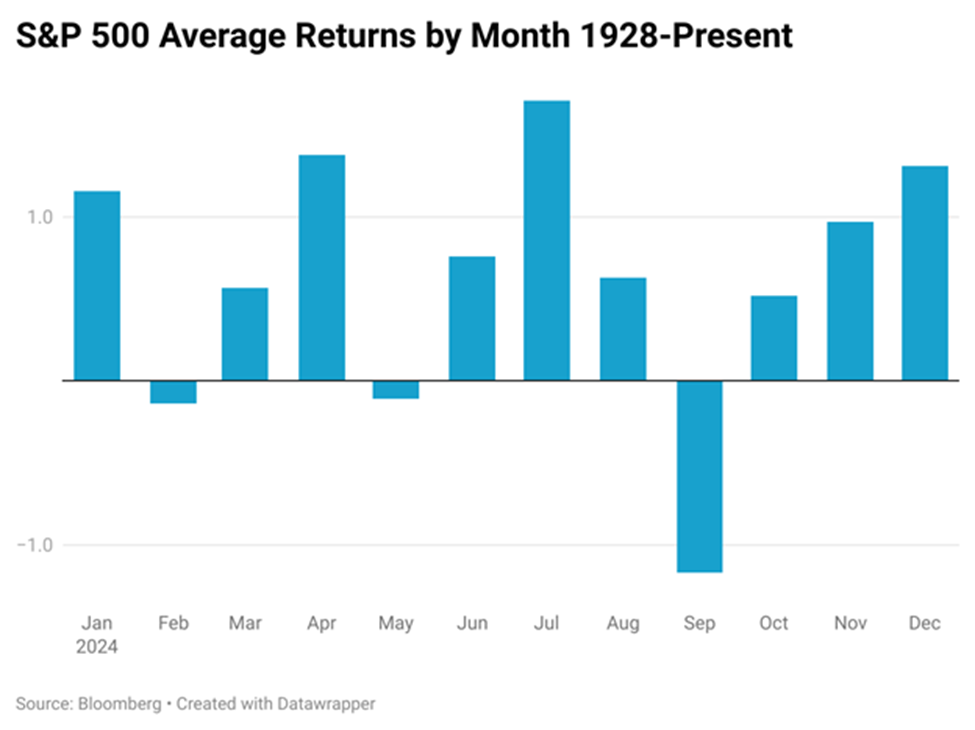

In an update this week, Luke noted how September is historically a terrible, horrible, no good, very bad month for stocks. Since 1928, stocks have averaged a 1.2% drop during this period.

The start of this September certainly lived up to the reputation. Earlier this month, we saw prices of the Nasdaq-100 fall as much as 6%.

However, things will change as we enter the fall. In his latest briefing, Luke talks about how a rare September event should mark the start of a multiyear bull market, and why high-quality AI firms are poised to do particularly well. In addition, he highlights three companies that he believes will skyrocket in the coming months.

The video, however, won’t be available for long. So, be sure to watch it here now.

Until next week,

Thomas Yeung

Markets Analyst, InvestorPlace

The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

On the date of publication, the responsible editor did not have (either directly or indirectly) any positions in the securities mentioned in this article.