If you’re searching for cheap quantum computing stocks to invest in for early next year, there are a few companies worth watching. I expect these companies to perform well throughout 2024 due to their continued development and the gradual roll-out of their development road maps.

Quantum computing companies are set to disrupt numerous industries with their technologies, ranging from healthcare to economic research and everything in between. The enormous leap in processing power will allow us to model previously impossible processes in classical computing.

As a result, there has been heavy interest from institutional investors in the space, and an arms race between companies to release the first commercialized quantum system is underway.

So, let’s dive in and discover the most promising affordable quantum computing stocks for 2024 and beyond. I think that these companies are bargains at their current levels that shouldn’t be ignored for too long by investors.

IonQ (IONQ)

IonQ (NYSE:IONQ) specializes in quantum computing, providing systems across major cloud services. Despite being in a developmental stage with minimal revenue, it’s a pioneer as the first pure-play quantum computing company to go public.

In the first quarter, IONQ achieved $7.58 million in revenue, marking a 77% increase compared to the first quarter of 2023. Despite the revenue growth, the company recorded a net loss of $39.6 million, which widened by 45% from the previous year.

For the full year of 2024, IONQ has raised its bookings guidance to between $75 million and $95 million, signaling confidence in its sales pipeline and business expansion.

Despite this, I still feel that IONQ is undervalued, as it trades for just $8.71 at the time of writing. It also has far lower valuation ratios than many of the FAANG, big tech stocks such as Microsoft (NASDAQ:MSFT) or Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL), thus making it one of those firms to consider.

Quantum Computing Inc. (QUBT)

Quantum Computing Inc. (NASDAQ:QUBT) focuses on both quantum software and hardware, with notable products like the Qatalyst software and quantum processing units. Its acquisition of QPhoton enhances its capabilities, aiming at practical applications across various sectors including finance and healthcare.

They’ve been particularly active in expanding their offerings, such as the introduction of the Dirac-3 entropy quantum computer, which is designed for complex optimization tasks.

One of the factors making QUBT’s offerings potentially appealing in terms of cost is their focus on creating quantum solutions that are both accessible and affordable. Their products are designed to operate at room temperature and consume low power, which reduces operational costs. These characteristics are intended to make their technology more practical and feasible for broader applications.

As of the end of September 2023, the company reported total liabilities of approximately $8.1 million, a decrease from the previous year. This reduction was primarily driven by regular debt repayments and a significant decrease in expenses. This then makes it one of those cheap quantum computing stocks by book value.

Rigetti Computing (RGTI)

Rigetti Computing (NASDAQ:RGTI) is known for its development and production of quantum integrated circuits and a dedicated cloud platform for quantum algorithms.

Their strategy includes expanding their technological capabilities and securing strategic partnerships with major organizations like NASA and the U.S. Department of Energy to advance quantum computing.

For 2024, Rigetti’s financial performance shows they are navigating a challenging phase, with a reported revenue of $3.05 million for the first quarter and an earnings per share (EPS) of -$0.14, missing the expected -$0.08 EPS by $0.06. This follows a pattern from the previous year, where their quarterly earnings consistently fell short of expectations.

Key valuation ratios for Rigetti include a Price/Sales (PS) ratio of 15.37 and a Price/Book (PB) ratio of 1.71. The forward PS is projected at 11.11. This then prices it favorably compared to many of its peers, and signals that it could be undervalued and therefore cheap.

Nvidia (NVDA)

Nvidia (NASDAQ:NVDA), traditionally known for its GPUs, is also involved in quantum computing, particularly through its simulation platforms that facilitate quantum computing research and development.

NVDA has developed the CUDA-Q platform, an open-source, QPU-agnostic quantum-classical accelerated computing framework. This platform is instrumental in integrating quantum computing units (QPUs) with classical computing systems like GPUs.

Recently, Nvidia announced the acceleration of quantum computing capabilities globally through their CUDA-Q platform, highlighting its deployment in Japan’s ABCI-Q supercomputer. This initiative is part of a broader strategy to boost national quantum computing efforts.

Although NVDA’s valuation ratios are high, this could be seen as fairly priced or even undervalued when compared to its growth potential. It’s also one of the few stocks that have numerous growth drivers that could spur share price appreciation: from quantum, to blockchain, to semiconductors and of course gaming.

IBM (IBM)

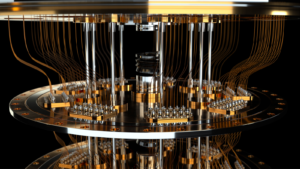

IBM (NYSE:IBM) is a major player in quantum computing, offering cloud-based quantum computing services and continuous advancements in quantum hardware and software. IBM Q System One is notable for its integration into the quantum industry.

IBM could be a pick for a cautious investor due to its historically low beta, dividend growth rate and yield, and stable history.

A notable development in IBM’s quantum development is their Qiskit platform, which is central to their strategy. Qiskit aids users in leveraging IBM’s quantum systems more effectively by simplifying the programming of quantum circuits and integrating quantum computations with classical processes.

IBM’s efforts are also supported by its extensive quantum network, involving collaborations with universities, research labs, and industry leaders worldwide to advance quantum computing applications.

IBM’s stock price is not cheap at $168 per share at the time of writing, and it has less aggressive growth prospects than others. Still, it may be worth considering for investors who want a less-risky foray into the world of quantum computing.

Microsoft (MSFT)

Microsoft quantum efforts include developing topological qubits and offering quantum computing services through Azure Quantum. Its holistic approach includes both hardware and software advancements in quantum technologies.

A major focus has been on achieving reliable logical qubits, a critical step toward fault-tolerant quantum computing. In partnership with Quantinuum, Microsoft has made a breakthrough by demonstrating logical qubits with error rates significantly lower than physical qubits.

Azure Quantum, Microsoft’s cloud-based quantum computing platform, is a central part of their strategy. It offers tools and services that enable users to write, run, and manage quantum code directly in the cloud. It is also developing its own toolkit exclusively for future quantum developers called Q#, which I think will give it a significant leg up over its competitors.

MSFT’s market cap at around 3 trillion makes it one of the most valuable in the world, so its valuation is not cheap on paper. However, I feel that it could be seen as undervalued when one takes its quantum progress into consideration and other growth headwinds such as AI through its partnership and investment into OpenAI.

Alphabet (GOOGL, GOOG)

Alphabet has made significant strides in quantum computing, claiming quantum supremacy in 2019. Its quantum computer, Sycamore, performed a calculation in minutes that would take traditional supercomputers much longer.

Alphabet has made notable advancements in both hardware and software for quantum computing. It is working on scaling up its quantum computers, with ambitious plans to increase qubit numbers to 1 million by the end of the decade, aiming for an error-corrected, commercially viable quantum computer.

Additionally, Alphabet has spun out its quantum technology efforts into an independent company called Sandbox AQ, which continues to work on applying quantum technology to enterprise use cases.

Just with the other big FAANG stocks in the quantum space, Alphabet’s valuation remains high. One thing to keep in mind though is that its EPS is set to soar over the next few years, increasing by double digit amounts.

Alphabet maintains an incredibly strong competitive moat with its Google and YouTube platforms, and its Gemini AI has shown promise in incorporating it into the search results.

On the date of publication, Matthew Farley did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.